There are reasons to be positive about 2023 as it is rare for difficult market conditions to endure for more than two years. In contrast to the dotcom bear market or the financial crisis, the pandemic-induced crash of 2020 is something that passed investors quickly, as the time ‘underwater’ only lasted about six months. During the longest of these setbacks – after the dotcom-induced bubble burst – negative sentiment lasted just short of three years.

With sharp interest rate rises, and an adjustment in the value of defensive investments, some areas of financial markets indicate that there are opportunities for investors who look ahead and can identify undervalued investments.

Positivity may not be the same for all asset classes and, as we pass through 2023, a fall in inflation, against a backdrop of weak economic growth, will likely see asset prices react and turn.

Which investments will improve and which might languish?

Inflation

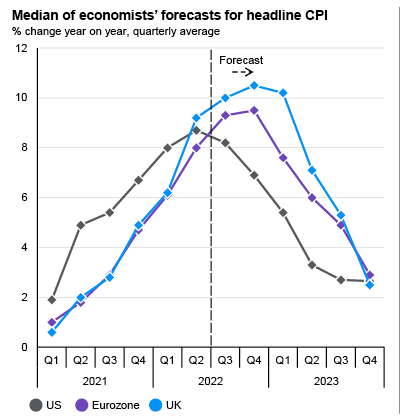

Inflation is expected to fall throughout 2023. Initially, this could be quickly. The pace will vary by geography and the US seems further ahead in the cycle. Current inflation expectations are a continuation of the trends we have seen in the recent figures. Inflation readings in the UK and Europe are starting to show the first signs of slowing while the US data shows the speed of price rises has been slowing since the summer.

Recent falls in the price of oil, transport and some commodities, and the flattening of gas prices, are a prelude to a reduction in the rate of annualised inflation. Falling inflation is good news for bonds and, normally, equities.

Most forecasts have inflation falling quickly in 2023

Source: JP Morgan Guide to the Markets, 2022

Interest rate influence

Higher interest rates means it costs more to borrow money. If credit cards, loans and mortgages are more expensive, then consumers will have less money to spend. Businesses face a similar problem with their loans, as they become more expensive to service. This eats into their profits and may result in redundancies to maintain profits as they adjust to weak consumer sentiment.

Interest rate increases typically take a year to 18 months before their influence is felt in the economy. As we pass one year since the first increase, we may start to see companies face more pressure than they did through 2022. Arguably, we already are starting to see this impact on firms. Alphabet and Meta (owners of Google and Facebook) have recently made redundancies, and there may be more to follow. The last 12 months has seen the quickest rate-rise cycle in the last half century and this should lead to higher unemployment, lower levels of spending and therefore low or diminishing profits. This will ultimately reduce inflation but will also shrink the economy. This is why we are widely expected to go into – or already are in – a recession.

As professional investors, we know that markets pass through cycles, and that investment prices will fall at times. The key is to remember that when markets fall, there are opportunities.

Recession

We have established that consumer and corporate behaviour changes during a recession. Normally, policymakers would be opting for expansionary policies in a recession – lower levels of taxation and higher levels of government spending. These stimulate demand and generate growth and help the economy pass through the cycle. However, the £50 billion hole in our public finances means we get the opposite, which will therefore reduce overall levels of demand.

There are ‘buffers’ against rate rises and higher taxes. Savings rates improved during the pandemic, more so in the US than the UK. Spare savings mean consumers can still spend and, to an extent, offset the higher costs from interest rates, energy and inflation.

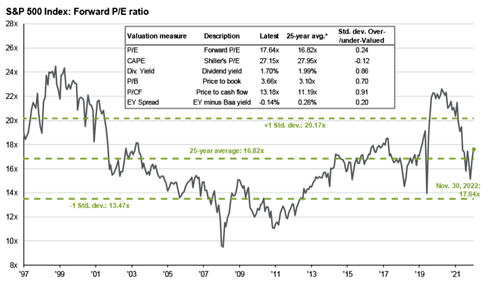

Investors and markets are split on the outcome. Equity markets think there will be a controlled slowdown, while bond markets have priced in a hard landing for the economy and a recession. Equity markets have fallen slightly and bond markets have reflected more difficult conditions. Are equities overvalued and bonds undervalued? In our view equities are no longer expensive, but bonds present a possible opportunity.

Outlook for equities

While equities are not expensive, they are not yet cheap and considering that rates are rising and profits might fall we think it is better to take a defensive position until a road to recovery becomes clear.

US equities are no longer expensive but are still not cheap

Source: JP Morgan Guide to the Markets, 2022

In equities we feel that ‘quality’ style investments, which tend to fluctuate less than a typical basket of equities, will perform better in the coming months. The underlying companies here are typically big, well-established brands which are less susceptible to a recession and can provide a good base for advisers looking to reduce volatility and risk.

Contrastingly, we feel that 'value' investments are less likely to perform well in the future environment. These typically consist of banks, energy, and oil and gas companies; all of which have been relatively resilient in the current environment. As we move past peak inflation and as expectations for interest rate levels fall, value investments might lose their allure. However, a balance needs to be found between reducing exposure to these value holdings and their potential for gains as, despite holding up well in an otherwise difficult period for equities, value investments are still very cheap historically.

In tough economic times, growth companies amplify the economic environment as they tend to fall first and often fall further than other stocks; this includes sectors such as advertising and consumer fashion. We believe that the higher rates have not fully affected these more economically sensitive investments as yet, but a time will come when exposure to growth investments will prove fruitful.

Outlook for bonds

The UK faces a different path for interest rates than in the US. We still expect interest rates to move higher and maybe at a slightly slower pace than in the US. The US has pushed rates higher, quicker, and is more likely to be on top of inflation. It is possible the US is further through the cycle.

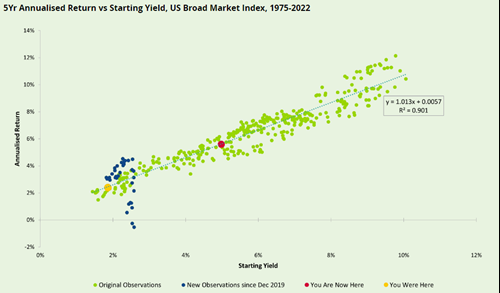

On the whole, bonds appear to be better value for investors. When investments fall it is easy for investors to look forward and project a trajectory, or to assume asset prices will remain depressed. This occurs from time to time in markets. Imagine if you had the foresight to be positive during the depths of the global financial crisis? Sometimes looking at long-term cheap-or-expensive valuation indicators can add perspective.

The longer-term picture

The chart below indicates when bonds may be cheap or expensive. When they are on the left, like in 2019, they are expensive. Valuations are now closer to the middle - so not very cheap but they are much better value.

There is an assumption with this model that an investor purchases now to hold for the next five years. What this means is that in the short term, markets can be volatile, and the cheap-expensive relationship breaks down. So in the short term we can say that bond prices might fall or rise, but in the long term there is higher potential and probability for better returns.

Bonds: cheap or expensive?

Source: TwentyFour Asset Managment using data from ICE/BofA Merrill Lynch, 2022

So what next?

The data above highlights the importance of context over a market cycle. The cycle can be made worse by shocks to the system. Opportunities arise during the cycle, and it is useful to set context around asset class performance.

We still have some tough months to navigate for equities, and bonds look more attractive at their current valuations and their prospects of a recovery are much better, especially if inflation materially falls.

As we saw throughout 2022, risks in markets evolve quickly and years do not always evolve as we expect. Advisers will need to be alert to changing market conditions in order to take advantage of possible upticks and bring value to their clients.

This is not a financial promotion and is not intended as a recommendation to buy or sell any particular asset class, security or strategy. All information is correct as at the date of publication unless otherwise stated. Where individuals or FE Investments Ltd have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

This communication contains information on investments which does not constitute independent research.