Earlier this year, our Financial Adviser Survey revealed that more and more of your clients are demonstrating an interest in sustainable investing, and that 72% of financial advisers now incorporate ESG factors into their proposition.

It’s also very likely that your clients will have differing views, preferences and priorities when it comes to sustainability. This means understanding your clients’ attitude towards sustainability is a growing importance.

To help, we’ve developed a Sustainable Investing Questionnaire, which is specifically designed to help you gain an initial understanding of your clients' attitude towards sustainability within their everyday life.

The results can then be used as the basis of a conversation to further understand their preferences when choosing investments. For example, do they only require a basic level of ESG filtering or are they very passionate about the way sustainability factors are applied to their investments.

This brand-new addition is available and can be used alongside our other onboarding functionality, which enables you to conduct key parts of ‘know your client’ from a single location – which includes fact find, attitude to risk, and anti-money laundering, to name just a few.

How to send a Sustainable Investing Questionnaire

To send your client a Sustainable Investing Questionnaire, simply visit the ‘Ethical’ tab and select ‘Send new questionnaire’. This will immediately send a request to your client asking them to complete the questionnaire, and they’ll be notified either by email, or receive a notification on their smartphone if they have the secure Portal app. You will also have the option to populate the questionnaire yourself while with your client.

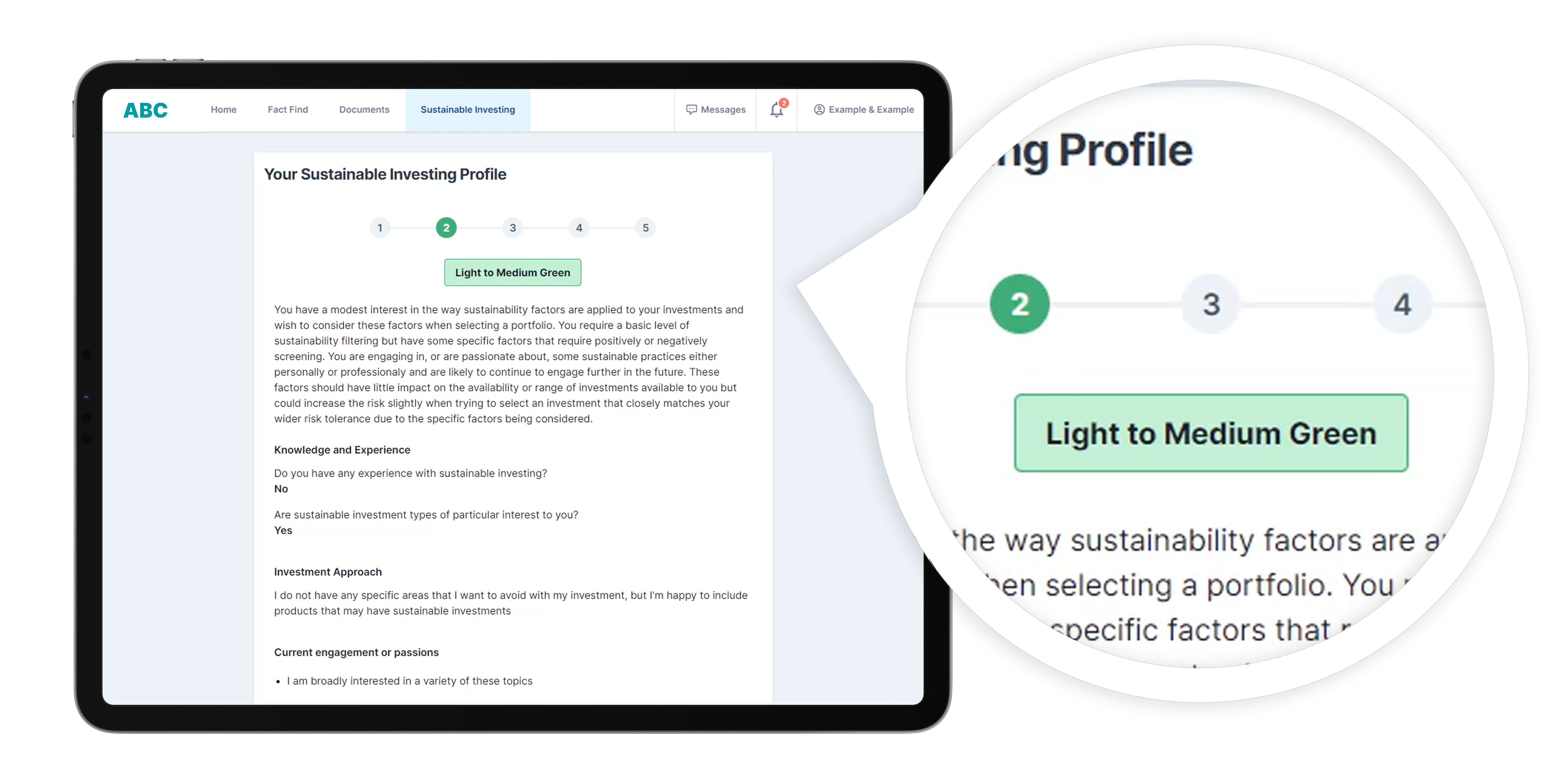

The questionnaire itself is simple to use and easy to understand, and dynamically responds depending on how your client answers questions. But fundamentally, it consists of 5 sections which are designed to help you gain an initial understanding of your clients' attitude towards sustainability within their everyday life.

Upon completing the questionnaire, your client will immediately receive a ‘Sustainable Investing Profile’. The results can vary along a 1 – 5 scale, ranging from ‘you require a basic level of ESG filtering’ through to ‘you are very passionate about the way sustainability factors are applied to your investments’. This information can then be used for further discussions.

Additional ESG-related features:

In addition to releasing a Sustainable Investing Questionnaire within CashCalc, we have also introduced even more ESG-related data into FE Analytics via the European ESG Template (EET). This means, you’ll be able to use CashCalc to help gain an understand your clients' sustainability preferences, before using FE Analytics to evaluate and better understand the ESG credentials of a fund.

This will help you when making an investment decision which is aligned with your clients' objectives and values. For example, you can use the ‘Fund Filter’ tool to start filtering funds based on its SFDR classification (articles 6, 8 and 9), and then gain a better understanding of a particular funds ESG credentials by opening its Factsheet.

You can also use the 3rd party ESG ratings from ISS we provide within FE Analytics, which offer an indication of the ESG performance of a fund.

As always, if you have any thoughts or ideas for improvement, please don’t hesitate to let us know. And if you would like to find out more about our Sustainable Investing Questionnaire, or any of our upcoming features, please don't hesitate to get in touch.

Sustainable Investing Profiles

For more information about what our 1-5 profiles mean, please read our Sustainable Investing Profiles document.