Consumer Duty aims to set higher and clearer standards of consumer protection across financial services, and requires all firms to act so they deliver good outcomes for their customers.

The Consumer Duty: what you need to know

The Duty can be broken down into three parts;

Consumer Principle

Principle 12 outlines the standard of care the FCA requires all firms to adhere to: “A firm must act to deliver good client outcomes for retail customers.”

Three cross-cutting rules

Everyone in the distribution chain must:

- Act in good faith towards retail customers

- Avoid causing foreseeable harm, and

- Enable and support retail customers to pursue their financial objectives

Four outcomes

Firms need to deliver and evidence the following outcomes throughout their relationships with retail clients:

- Products and services

- Price and value

- Consumer understanding

- Consumer support

The outcomes in more detail:

Products and services should be appropriate for the target market they are designed for and distributed appropriately. Advisers therefore need to clearly understand their clients’ needs and objectives, capacity for risk and loss, as well as ensuring that any vulnerabilities are considered before recommending suitable products and services. Every investment decision and client communication will need to be evidenced, and ongoing monitoring should take place to ensure that products and services continue to be suitable.

Consumers should receive fair value. Advisers will need to complete fair value assessments of their advice services and demonstrate that there is a reasonable relationship between the price paid for a product or service and the overall benefit a consumer receives from it. Thorough due diligence, reporting, use of technology and client feedback is essential to meeting this outcome.

Consumers are to be given the information they need, at the right time, and presented in a way they can understand. Communications should be tailored to each customer, including any characteristics of vulnerability, with the advice firm evidencing they have made any necessary changes to ensure customer understanding and provide good outcomes.

Customer service should enable consumers to realise the benefits of the products and services they buy and ensure they are supported when they want to pursue their financial objectives. This means that advice firms should consider how they support and service their clients; ensuring that processes and systems are straight-forward, easy to use and enable clients to disclose their needs and vulnerabilities. Firms should tailor communications and services to support their clients’ needs. Furthermore, they should ensure clients are getting the most from products and services, and that they are in line with their expectations.

How we can help you meet the Consumer Duty Challenge

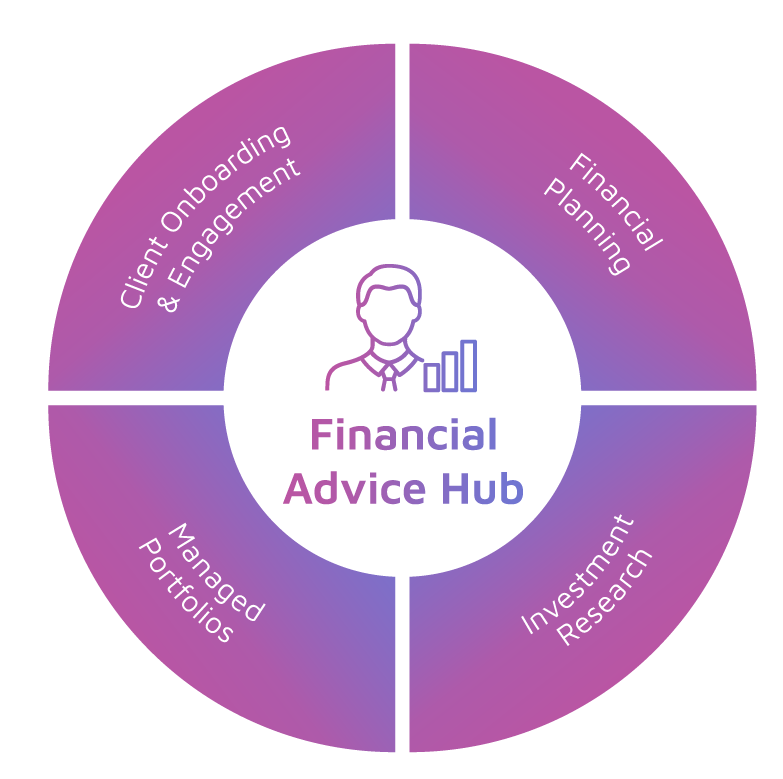

The FE fundinfo Financial Advice Hub helps financial advisers onboard and engage their clients, create financial plans, analyse investment options, and invest in managed portfolios. Advisers can utilise our technology, data and investment portfolios as part of their advice process to meet the requirements of Consumer Duty.

Our single advice ecosystem enables greater efficiency, reduces manual re-keying of data, and therefore provides you with more time to spend with your clients ensuring they receive the very best level of service and good outcomes.

Here's how:

Onboarding and digital fact finding

FE Onboard enables clients to complete their fact find, attitude to risk questionnaire and sustainable investing questionnaire remotely through a bank-level secure Portal.

You can use this information to collect and assess your clients' preferences, objectives, and capacity for risk/loss, and to segment your client base.

Digitalising this important process saves you time and allows you both to focus on what really matters most when you are together.

Key benefits:

- Our secure client Portal enables clients to complete a digital fact find (which can be customised), and onboard themselves remotely, ideal for vulnerable clients who may not be able to meet with you in person or require assistance collecting data and completing forms.

- The Portal can be white-labelled to include your company branding.

- Conduct remote attitude to risk and sustainable investing questionnaires.

- 2-way document exchange enables both you and your clients to digitally share documents.

- Documents can be digitally accepted, meaning clients can receive, read and agree to documents, such as your terms of business and fee agreement, remotely.

- Secure messenger and full history of communications with your clients and signed documents.

- Integrates with your back-office for further efficiency and to remove the chance of manual input errors.

- Client review date reminder keeps you one step ahead of the review process.

- Tagging functionality to segment client base and highlight any specific needs or vulnerabilities.

- Bulk send communications and documents to segments of your client base.

Outcomes supported:

Products and services

Price and value

Consumer understanding

Consumer support

Cashflow modelling and financial planning

FE CashCalc’s integrated suite of financial planning tools are specifically designed to help the entire financial planning process. From creating powerful lifetime cashflow plans to enhancing client engagement with simple and visual reports, FE CashCalc provides the tools you need to do your job.

Key benefits:

- Net and gross cashflow modelling tools build your financial plan and show clients in real time how it may behave with the option to refine it if required.

- Add life-changing events into a timeline and demonstrate how you have considered risks that can affect your clients’ financial plans and goals.

- Stress testing and forecasting visually bring the financial plan to life and help prepare clients for worst case scenarios, as well as ensuring that recommendations meet their needs.

- Create powerful and engaging reports which are easy to understand and empower your clients to make informed decisions.

- Complement the cashflow plans you create by using our entire range of financial planning tools, which includes mortgage, investment, protection and IHT tools.

Outcomes supported:

Products and services

Price and value

Consumer understanding

Investment research and analysis

FE Analytics is one system for fund research, portfolio construction, analysis, risk profiling, reporting and monitoring. It provides a holistic view of your investment proposition, ensuring investment suitability and increased efficiency, and demonstrating the value of your advice to your clients.

Key benefits:

- Attitude to risk questionnaire helps assess your clients’ capacity for loss/ risk and the Investment Planner tool then helps you map the outputs to a suitable investment option.

- Unrivalled data - compare over 300,000 investments, including over 75 DFMs from the MPS Directory, as part of your in-house due diligence.

- Bespoke branded reports can be created with your desired data filters such as ESG data and ratings, ratios, performance, sectors, and a myriad of other data to assess and compare potential funds and portfolios, clearly laid out in a simple format for clients.

- Detailed factsheets and reports clearly define product objectives and associated risk targets/profiles to ensure compatibility.

- Value for Money fields and Assessment of Value reports where available to help assess fair value.

- Portfolio comparison reports enable you to compare your clients’ existing investments against alternative solutions.

- Costs and charges calculators ascertain the true product costs to invest, helping you demonstrate the fair value of your services and any proposed switches.

- Easily monitor portfolio returns and get alerted on any significant changes to the underlying investments.

- Demonstrate the value of your investment advice using our Dynamic Portfolio Tool to show ‘what if’ scenarios.

Outcomes supported:

Products and services

Price and value

Consumer understanding

Managed Portfolio Service

FE Investments’ data-driven, risk-focused portfolios are constructed with your clients’ needs in mind. Expertly built with a focus on diversification, our managed portfolios provide you with a range of strategies to fit your clients’ differing needs, attitudes to risk and can be aligned to your Centralised Investment Proposition and Centralised Retirement Proposition.

Key benefits:

- Partnering with us for the daily management, monitoring and rebalancing of your clients’ investment portfolios means you can focus on spending more time with your clients helping them meet their financial goals and adding further value.

- Our investment philosophy focuses on risk management and maximising diversification. The process combines decades of fund data analysis and sector leading technology with the expertise of a dedicated investment team to help your clients achieve their investment goals and keep them regularly informed along the way.

- Range of managed strategies with differing risk profiles and objectives to meet both your needs and align to the retail client lifecycle with a ‘toolkit’ of solutions from accumulation to retirement. Option to take this one step further with a tailored solution adapted to meet the specific needs of your clients and business model.

- The portfolio management process is dynamic and continuous. Our portfolios have regular rebalancing points but we also make incremental, value-added adjustments as required.

- The portfolio strategy considers cost-benefit analysis to ensure that every investment decision taken is carried out in the investor’s best interest and justifies any additional costs.

- Regular investment updates, client-friendly reports, videos and other supporting documentation is available through an adviser portal to keep you informed and help you evidence your investment decisions and update your clients on performance.

- Enhanced ESG reporting is available for all portfolios, providing more information on the facts that matter. The reports are designed to integrate easily with your day-to-day advice and client-management.

- The portfolios are fully integrated with FE Analytics so you can conduct your due diligence and evidence your investment decisions.

- Strategic partnership – our experienced team will work with you to ensure you get the best from our solution and that your clients receive the support and jargon-free reporting you need.

Outcomes supported:

Products and services

Price and value

Consumer understanding

Consumer support

Important information

This is a marketing communication, intended for financial advisers only. Not for use by retail investors. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. The value of investments and the income from them may go down as well as up and you may not get back the amount originally invested.

In summary

The Consumer Duty may not be a complete rewrite of the rules and the emphasis on putting the customer first is nothing new, but it does means that firms across the industry must demonstrate how they put the customer first and build the Duty into their culture.

By utilising our technology to power your advice process, and through evidencing your investment decisions with data-backed research and products, not only will you have a streamlined and efficient investment proposition, you'll also have embedded Consumer Duty into your business and will increase the value and good outcomes you provide for your clients.