Sustainable and ESG investing is becoming an increasingly important part of financial planning, with almost two-thirds of financial advisers witnessing an increase in the amount of client money being invested into ESG and sustainable investments over the past year alone according to our latest adviser survey.

Through our products and services, advisers can power their sustainable investing proposition and provide good client outcomes which are aligned to their values.

How we can help:

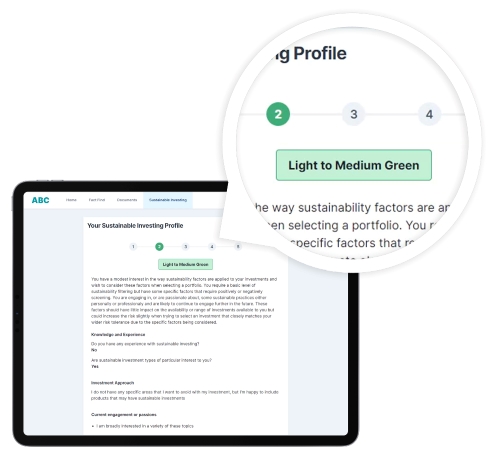

Assess your clients' sustainability preferences

It's very likely that your clients will have differing views, preferences and priorities when it comes to sustainable investing.

The Sustainable Investing Questionnaire within FE Onboard is specifically designed to help you gain an initial understanding of your client's attitude towards sustainability within their everyday life.

The results can then be used as the basis of a conversation to further understand their preferences when choosing investments. For example, do they only require a basic level of ESG filtering or are they very passionate about the way sustainability factors are applied to their investments?

Key benefits:

It's simple and easy to use

Send the questionnaire via our Secure online Portal for your clients to complete remotely or fill it in together in person. The questionnaire dynamically responds depending on how each question is answered and provides a simple 1-5 score.

Tailored to their lifestyle

Consisting of 5 sections, our ESG questionnaire seeks to understand how sustainability fits in to day-to-day life in order to build a profile of your client and to what extent ESG may impact their investment choices and objectives.

Engage your clients

Alongside the 1-5 score, the ESG questionnaire provides feedback on your clients' preferences, enabling you to have a further and meaningful conversation with your client around sustainability and to allow you to identify suitable investment options.

Research ESG funds and investments

Researching and analysing ESG funds and investments can be tricky, but award-winning FE Analytics is a one-stop tool for all your fund research and analysis and can power your sustainable investing proposition.

Create bespoke reports with your desired data filters such as ESG ratings, European ESG Template (EET data), performance, sectors and a myriad of other data in order to assess and compare potential funds and portfolios. The reports can be saved for later and used to demonstrate your investment decisions and support conversations with your clients.

With all this ESG data at your fingertips you can confidently research and assess suitable investments for your clients, and meet the requirements of Consumer Duty by demonstrating and evidencing your commitment to supporting your clients achieve their financial goals and delivering good client outcomes.

What you can do:

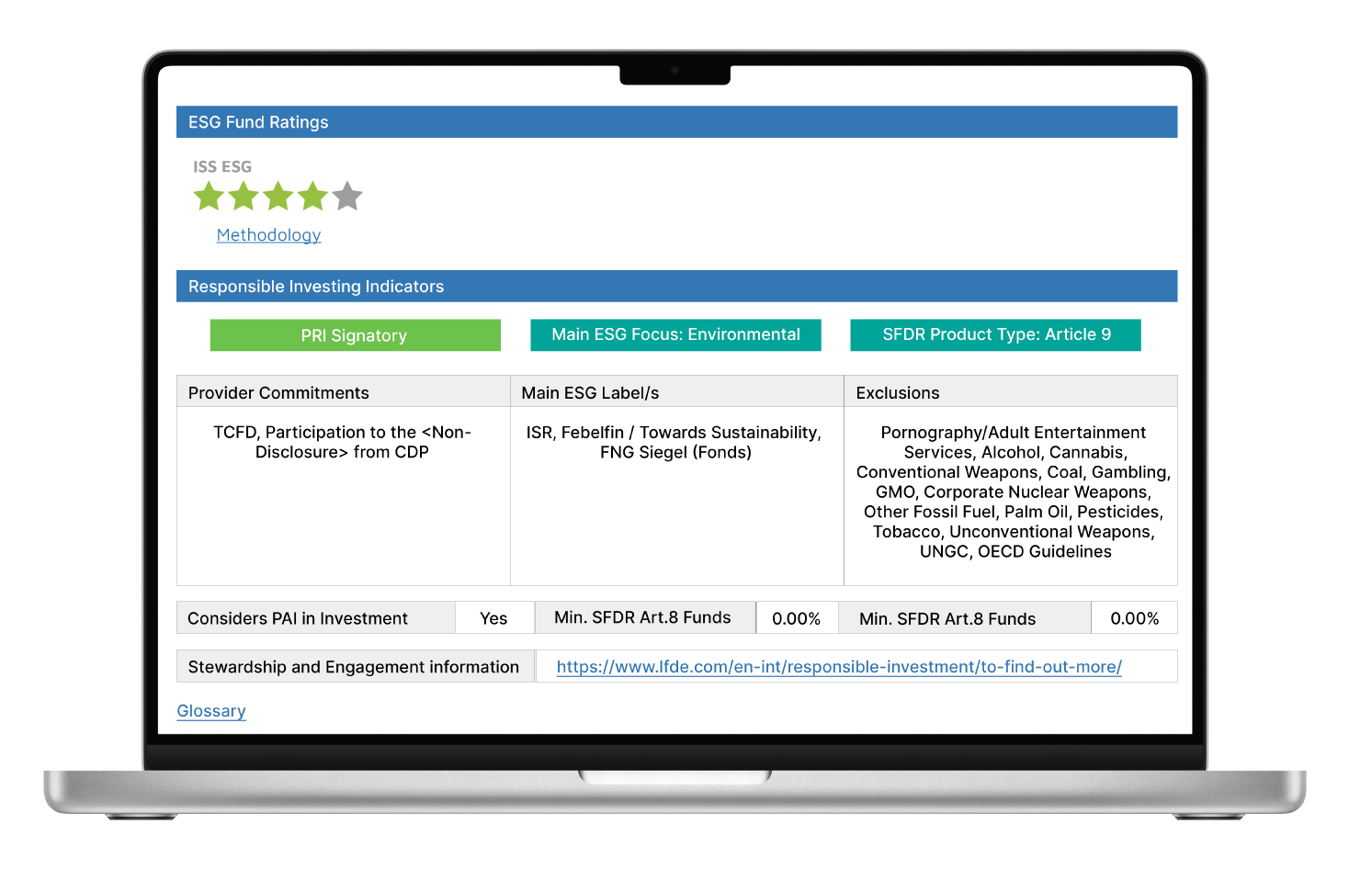

Utilise a broad range of ESG data

Use the 'Responsible Indicators' section of the Fund Factsheet to view key EET data and assess the ESG characteristics of a fund, and whether it aligns with a client’s specific criteria.

Assess ESG performance

Use ESG Ratings from ISS to gain an indication of the ESG performance of funds, supporting you in making investment decisions aligned with your clients’ investment objectives and values.

Filter based on specific criteria

Use the fund filter to search by ESG Ratings or SFDR classification in order to further assess the ESG approach of a fund.

Invest responsibly with FE Investments

If you would rather select a ready-made responsible investment solution for your clients, FE Investments can help. Our Responsibly Managed range cuts through this complexity to focus on the things that really matter, so you can help your clients invest with the peace of mind that their money is doing good in the world.

The range consists of 15 portfolios, with five risk-optimised portfolios spanning three investment time horizons. This wide range of portfolios allows you to invest responsibly in a portfolio that matches your clients’ financial objectives. The portfolios include a blend of passive and active funds, balancing the cost benefits of passive funds with our expertise in selecting the best active fund managers.

How we can help:

Responsibly Managed Portfolios

Our Responsibly Managed range aims to build on our core principles of doing less harm and doing more good, while delivering on our risk and return profiles.

The portfolios are constructed with our key ESG principles in mind to make sure that your clients’ money is having a positive impact on society and the environment.

Engaging for a positive impact

We don’t just incorporate responsible principles into our investment decisions, we also try to influence the industry to improve by engaging with fund groups.

As a multi-billion pound investment business we are able to use our size to put pressure on fund groups to improve their processes and to push for outcomes we view as having a materially positive impact.

Enhanced ESG reporting

In addition to standard portfolio reporting, all our portfolio ranges have enhanced ESG reports available.

Designed to enable better conversations with clients and enhance suitability assessments, the reports provide clear and simple data to help overcome the complexity of ESG terminology and frameworks.

The reports provide clarity on where your clients’ money is invested, and the impact it is having on the world around them.

Important information

This is a marketing communication, intended for professional investors only. Not for use by retail investors. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. The value of investments and the income from them may go down as well as up and you may not get back the amount originally invested.