Asset managers are struggling with data management.

Covid-19 accelerated the pre-existing trend toward a digital-first economy and as the business world evolves, fund managers must adapt their data management strategy to ensure they continue to unlock the value in data, rather than drown in it.

Some asset managers realise the need for an effective and comprehensive data strategy and already have a data-driven culture permeating throughout the business. Most organisations (61%), however, are at the stage of thinking about data in a transformative way but do not have a comprehensive data strategy in place.

A fund manager’s data strategy should begin with a clear view on what data problems have arisen in the past, caused by the proliferation of rising amounts of data, and how the organisation can adapt in the future to an industry where competitors and customers are becoming more data literate, data-driven and demanding of seamless, instant and engaging digital experiences.

Data management challenges for the asset management industry

Fund managers can struggle to achieve sustained data quality, consistency and coordinated data management capabilities across all regions. This means analysts can spend time siphoning through incorrect or raw data, reducing the time they have available for strategic thinking and client interaction. They can also allocate considerable time into processing data, dealing with incompatible formats and separating useful from non-useful data. For example, funds with Swing Pricing have two different NAVs, a calculation NAV and a transaction NAV. Therefore, adding a new field to the organisation’s database isn’t enough. The existing data has to be checked and completed correctly as well.

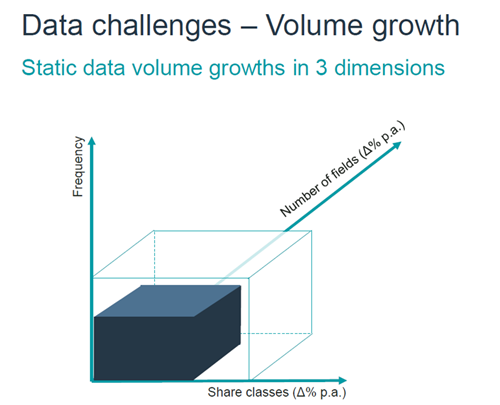

Furthermore, analysis conducted by FE fundinfo revealed that volume growth, driven by the three dimensions of increasing number of fields, frequency of delivery and the number of share classes, could see the volume of data for some asset managers growing up to 39% per annum.

‘Golden Source of Truth’ – The key ingredient to your data strategy

One aim that should be part of all data strategies is to remove data silos within the company and replace them with a ‘golden source of truth’. Data silos create an environment where different business functions view or process data in different ways, risking either time or cost due to duplicated or inaccurate data, mishandling and/or misinterpretation.

Having a golden source of truth is critical to data governance. In recent years, asset managers are required to adhere to new, more stringent and more frequent changes to regulations, meaning quick, transparent and easily accessible fund data is required for audit and reporting purposes.

Transparency is key from a regulatory perspective and having control and clarity of all the data involved in successfully managing a fund can mitigate compliance risk. Organisations must also think seriously about data security in a digitalised world – business critical data needs to be stored securely and be easily identifiable for audits.

Steps fund managers can take to solve data management challenges

There are steps fund managers can take to move nearer the golden source of truth.

A holistic data management platform can make it easier for an asset manager to share regulatory data in a secure, auditable and efficient manner. It enables the data management of share classes throughout the lifecycle of a fund; inception, regulatory registration, document production, automated workflow management and data distribution.

FE fundinfo’s integrated content, workflow and document management tool; publiFund, can help you transform the way your company manages fund data and documents, and improve your distribution operations and client reporting at scale.