Digitally onboard your clients with our secure Portal

Our secure Portal enables both you and your clients to securely communicate and share information with each other remotely. This means tasks can be completed ahead of an initial meeting, saving you time and allowing you both to focus on what really matters most when you are together.

Key tools and features

Secure Portal

Our secure Portal, which contains bank-level encryption (AES-256), enables both you and your clients to securely communicate and share information with each other throughout your entire financial planning process. It can be completely white-labelled with your company branding and clients can either be invited to create their very own secure Portal or they can even 'self-onboard' themselves.

Digital Fact Find & Custom Fact Find

Our Digital Fact Find (which can be customised) enables you to gather personal and financial information about your clients remotely, saving you time and making your process much more efficient. Plus, information entered into a Digital Fact Find can be seamlessly sent to all the other software providers you use via integrations, therefore reducing the need for you to manually key any client information and retaining its accuracy.

Document Exchange & Digital Accept

Our 2-way Document Exchange enables both you and your clients to digitally share documents with each other via the secure Portal, eliminating the need for a manual exchange. Documents can be digitally accepted, which means clients can receive, read and agree to documents, such as your terms of business and fee agreement, remotely. When this feature is combined with the Secure Messenger, you and your clients truly can communicate and share information with each other securely.

Secure Messenger

Our 2-way Secure Messenger enables both you and your clients to safely and securely communicate and share information with each other, offering an alternative to less secure communication methods such as email. Both you and your clients can exchange direct messages remotely, and any messages sent will immediately ping a notification to help enhance engagement.

Integrations

By digitally onboarding your clients and integrating your account with all the other software providers you use, you can streamline your process and reduce the need to manually key any client information. We integrate with all major back-office systems, as well as other software such as Credas for remote Anti-Money Laundering checks and EValue for Attitude to Risk Questionnaires. Please click here to view our integrations hub.

Plus more

- Conduct remote Anti-Money Laundering checks

- Conduct remote Attitude to Risk Questionnaires

- Conduct remote Sustainable Investing Questionnaires

- Automatically generate Letters of Authority

- Option to include open banking/finance within your Digital Fact Finds

- Share custom web links, such as your company website

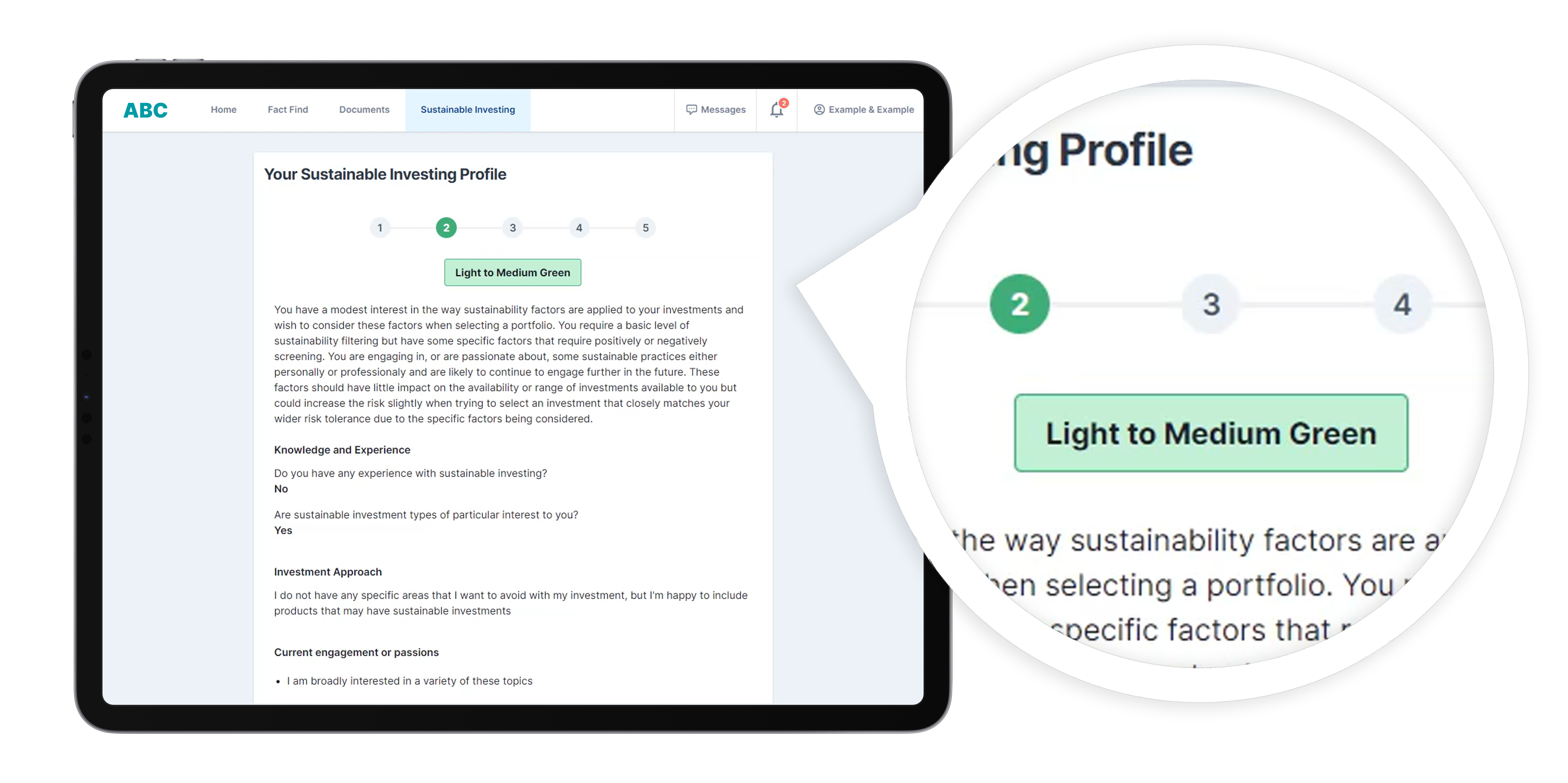

Assess your clients' sustainability preferences

Our Sustainable Investing Questionnaire is designed to help you gain an initial understanding of your clients' attitude towards sustainability within their everyday life. Upon completing the questionnaire, your client will immediately receive a ‘Sustainable Investing Profile’.

The results can vary along a 1–5 scale, ranging from ‘you require a basic level of ESG filtering’ through to ‘you are very passionate about the way sustainability factors are applied to your investments’.

This information can then be used for further discussions.

Discover what's included within our secure Portal

From completing a fact find to exchanging documents, we have everything you need to digitally onboard your clients from the very beginning. This eliminates the need to conduct manual onboarding tasks, and is the key to unlocking a more engaging and much more efficient process.

Find out how and why you should use our secure Portal

Discover how individual features can really benefit your onboarding process, and why our secure Portal is the highest rated Portal by financial advisers*.

How to invite your clients to create a secure Portal

Find out how to send your clients a secure link inviting them to create their very own secure Portal.

Why exchange documents digitally with clients?

Discover why you should consider digitally exchanging documents instead of physical versions.

How to create a custom digital fact find

Find out how to add questions to the digital fact find, or even create a brand-new custom version.

How to send a sustainable investing questionnaire

Find out how to send a questionnaire to your clients through their secure Portal and how to use their results.

Simple and transparent pricing

Not ready for a trial? Discover more about digitally onboarding your clients

Not ready for a trial? Discover more about digitally onboarding your clients

Digital onboarding solutions

*based on our Return On Investment calculator which uses information from the FCA, NextWealth, Platforum, and our own research/expert opinion

*NextWealth, 2021