Regulatory pressure, coupled with the rise in inflation and the cost-of-living crisis, is placing a spotlight on how advisers deliver investment solutions for retirees. How can you ensure your approach is robust, compliant, and balances risk appropriately?

Outdated Approaches

FE fundinfo's 2023 adviser survey showed that 70% of advisers now have a Centralised Retirement Proposition, an increase from just under half of all advisers surveyed a year ago. What’s more, an additional 20% are planning to develop one. It’s clear that advisers are aware of the importance of offering a portfolio that provides income in retirement.

However, it’s possible many advisers are missing the mark with these solutions with many focusing on sequencing risk alone. Sequencing risk should of course be considered, but shortfall risk cannot be ignored.

“There is a broad consensus among advisers that capital protection in the early retirement years is important because of the potential impact that falling markets will have on future withdrawal amounts. Holding cash – or cash-like – investments remains a popular strategy, but also having an investment return that keeps pace with inflation over the longer term will be equally important.”

Toyosi Lewis, Retirement Specialist, FE Investments

Regulatory Pressure

In January 2023, the FCA announced that it had decided to proceed with its review of the retirement advice marketplace – given the catchy title: “Assessing Suitability 2”. The regulator has been interested in understanding how the retirement income advice market was functioning, especially since the introduction of the Freedoms in 2015. Unsurprisingly, in its latest announcement, it also wants to understand how consumer needs are changing as a result of the rising cost of living.

Coupled with recent changes to pension regulation and the far-reaching impact of Consumer Duty, this amounts to significant regulatory pressures on the suitability of your at-retirement philosophy and process. You may want to get a head start on assessing whether your CRP is meeting client needs.

Client Outcomes

Retirement income advice is a complex area. Some clients think they only need an adviser when they first access their pension savings. However, the need for good advice continues on an ongoing basis after that pot of money has been accessed. Since 2015, drawdown has led to more flexibility for clients, but it does require the help of advisers with financial planning. Under Consumer Duty, you may be asking: How can I demonstrate I am providing the right products and services to meet my client’s retirement needs and are they delivering the right client outcomes? To answer this, reassessing your offering could be essential.

Income Sustainability

The regulator may use its own data (Retirement Income Market Data) to ask difficult questions of the industry. 40% of regular withdrawals were taken at an annual rate of over 8% of the pot size, despite the fact that three quarters of advisers believe either a 3% or 4% annual drawdown rate to be sustainable. (FE fundinfo’s 2022 Adviser Survey). This is, of course, impacted by inflation and the cost-of-living crisis but what is crucial to clients is whether this increase in drawdown is sustainable, or is it significantly more likely they run out of money?

Any response that clients spend less money as they age seems incorrect (IFS May 2022 p.34). So, does your approach balance risk to ensure clients are maximising income from their portfolio in retirement? Or is there a significant risk of your client outliving their retirement portfolio?

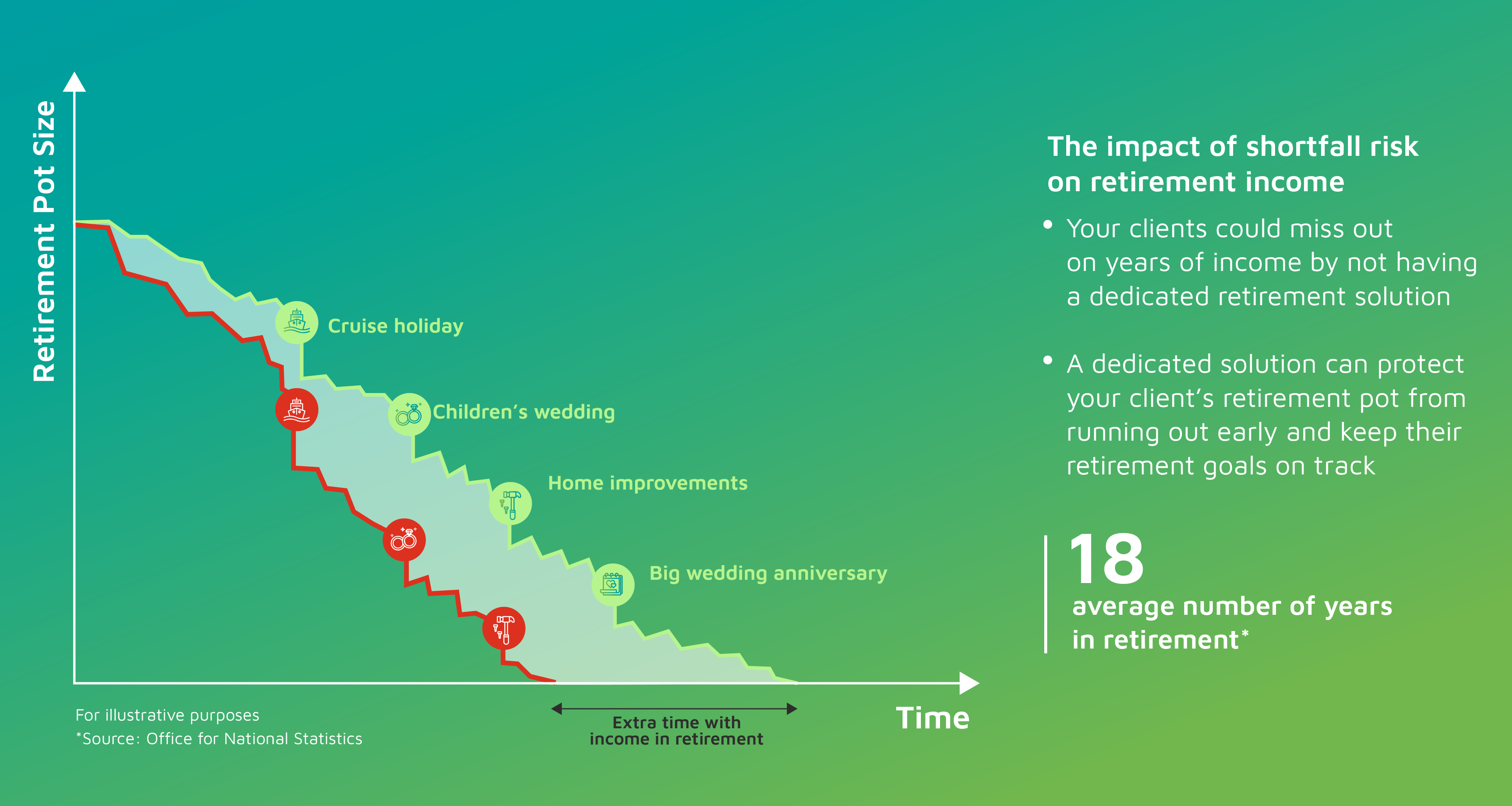

Shortfall risk, where a retirement pot runs out and is unable to provide an income for the entirety of retirement, is one of the primary risks associated with retirement planning. The graph below shows the expectation gap that can result from not giving this enough weight.

The Role of Advice

Ultimately, in your role as an adviser, you understand each client’s individual requirements and their retirement goals most clearly. Clients will still need effective advice to manage the expectation gap between how much they believe they can take as income in retirement and reality. In order to overcome this, it may be beneficial to adopt a different approach to help your clients squeeze a little more out of their portfolio. Otherwise, they may be slightly disappointed by the style of retirement they are left with.

With this in mind, now may be the right time to re-examine your CRP and assess whether it will deliver good customer outcomes and income sustainability for your clients. Does it equip you with the optimum range of portfolio options – both in terms of risk profile and time-frame – and also the necessary tools to monitor the progress of a client’s retirement plans and respond to changing consumer needs? Not least changes due to the ongoing cost-of-living crisis and the impact of inflation.

What’s clear is that you need a solution that fits into your retirement process and considers this potential risk of running out of money while not focusing on sequencing risk alone. If you were to think about risk in those terms, you need to structure your processes in ways that ensures they are compliant.

“For many investors it may seem counterintuitive to think about increasing their risk exposure as they approach retirement, but in a decumulation portfolio, the bigger risk might be running out of money rather than the value of an asset falling. As an industry we need to do more to empower advisers with innovative investment solutions, in order to have these conversations with clients and move away from models and strategies which have perhaps run their course.”

Toyosi Lewis, Retirement Specialist, FE Investments

How can FE Investments help?

FE Investments believes in helping advisers achieve better outcomes for your clients and your own business.

FE Investments also offers a Decumulation portfolio range so you don’t have to create from scratch an investment strategy that provides both growth and sustainable income for a broad range of risk profiles and investment terms.

This allows you to spend more time with clients, coaching them on how to deal with market swings, and changing their retirement plan where necessary. Using a probability-based approach, FE Investment’s Decumulation portfolio range aims to provide your clients with a well thought out, planned and sustainable income drawdown during retirement.

From our position as part of FE fundinfo, which informs and connects people and businesses from across the fund industry through data, our experts can offer insights into what impact current developments are having on the advice industry and help with constructing an effective CRP.

We've also produced a guide to help you when developing your retirement solutions for clients.

Important information

This is a marketing communication, intended for professional investors only. Not for use by retail investors. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. The value of investments and the income from them may go down as well as up and you may not get back the amount originally invested.