Providing suitable retirement advice has never been harder for financial advisers.

Yet, there are opportunities out there – as FE Investments points out – for those who are looking to stay ahead of the curve by changing their approach to risk.

With the current backdrop of vast amounts of regulatory change – including the introduction of Consumer Duty rules and the FCA’s upcoming review of retirement advice – as well as the implications of inflationary pressures and the cost-of-living crisis, financial advisers find themselves in the unenviable position of delivering positive outcomes for investors who are planning to retire or have already retired.

One barrier in their way, however, is outdated attitudes to risk in a saver’s investment portfolio. Yet, there are options available, and there are business opportunities for those advisers who have the right, data-driven, tools and products to show savers in – or approaching – retirement, the benefits of a different approach which will help to deliver positive saver outcomes.

Rethinking risk

One key area for savers and financial advisers alike, is rethinking what risk looks like at-retirement. Savers’ objectives change as they approach retirement, so too does the way they should think about risk.

There are additional risks to be considered for investors in the decumulation phase as well as some familiar ones from accumulation. Around and following retirement, longevity and sequencing risk need to be balanced appropriately to allow risk to be considered in the context of whether the investor will be able to afford the lifestyle they desire throughout the duration of their retirement.

As such, traditional risk questionnaires, models and projections built around volatility bands and growth are not ideal for decumulation investors. There is a danger to the adviser that they are still measuring attitudes to the wrong risk in retirement, which not only isn’t compliant but leaves advisers exposed to accusations of mis-selling in the future.

The right tools for the job

FE Investments’ Decumulation Illustrator encourages retirees to think about risk in a different manner to how they may have done in accumulation.

Risk is often framed as volatility in accumulation, which illustrates how extreme the movements in the value of their investments may be and, therefore, the possible losses that could occur.

FE Investments’ Decumulation Illustrator tool instead frames risk as the probability of the investor running out of money. It allows financial advisers to discuss income drawdown in a way that is relevant, meaningful and understandable to investors.

If investors are going to be withdrawing money from their investments, the expected return has to be sustainable given the withdrawal rate. As an example, a 4% withdrawal rate could easily increase to 6% once all charges are included.

Despite this, it is still common during retirement for investors to stay in low-risk portfolios because this matches their attitude to risk, even though they would have no chance of maintaining a withdrawal rate anywhere near 6%. In this case the investors would be forced to reconsider their desired lifestyle in retirement, which is already an acute concern following the cost-of-living crisis.

For this reason, the Decumulation Tool places investors in a higher risk portfolio than they may have been invested in during accumulation, helping maintain a savers desired lifestyle.

Retirement portfolio options

With the right set of tools in place, advisers can then look to enhance the investment portfolio options they are able to provide to savers.

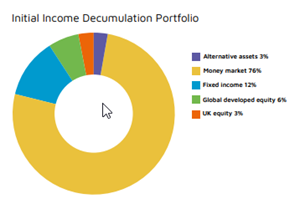

To assist, FE Investments has also designed two model portfolios, each specifically made for distinct retirement risks. The first is the Initial Income Portfolio. This portfolio’s defensive positioning means that it takes a reduced level of market risk and insulates against a large market fall, meaning investors can withdraw money from it on a regular basis with relative confidence.

Required income should be withdrawn from this portfolio in the initial instance until the portfolio value is run down to nothing. The growth potential of the portfolio is limited; therefore it is not suitable as a long-term holding as it would not be able to sustain a long-term retirement. This portion of the portfolio provides protection in the event of a market fall, but would act as a drag on performance in a strongly performing market.

Should markets fall early in retirement the Initial Income Portfolio provides time for other high-risk investments to recover, potentially adding a number of years over which the portfolio will be able to pay out an income.

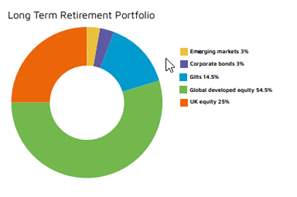

The remaining portion of the portfolio could be placed in FE Investments’ Long Term Retirement Portfolio that is still diversified across multiple asset classes. It believes this offers the best chance for savers to meet their income needs over the longer term.

*Charts from FE Investments and are for illustrative purposes only

For more information on FE Investments’ decumulation portfolios click here.

Important information

This is a marketing communication, intended for financial advisers only. Not for use by retail investors. It is not intended as a recommendation to buy or sell any particular asset class, security or strategy. The value of investments and the income from them may go down as well as up and you may not get back the amount originally invested.

---

Toyosi Lewis, Retirement Investment Specialist, FE Investments

(First appeared in Professional Adviser on 28/06/2023)